Find Trusted GA Hard Money Lenders for Real Estate Loans and Investments

Find Trusted GA Hard Money Lenders for Real Estate Loans and Investments

Blog Article

The Ultimate Guide to Finding the most effective Difficult Money Lenders

Browsing the landscape of hard money lending can be a complicated venture, needing a complete understanding of the numerous aspects that add to a successful borrowing experience. From assessing loan providers' track records to contrasting rates of interest and charges, each action plays an essential duty in safeguarding the ideal terms feasible. Establishing effective interaction and offering a well-structured service plan can considerably influence your communications with lending institutions. As you think about these elements, it comes to be noticeable that the path to identifying the right tough money lender is not as uncomplicated as it might appear. What crucial insights could better boost your method?

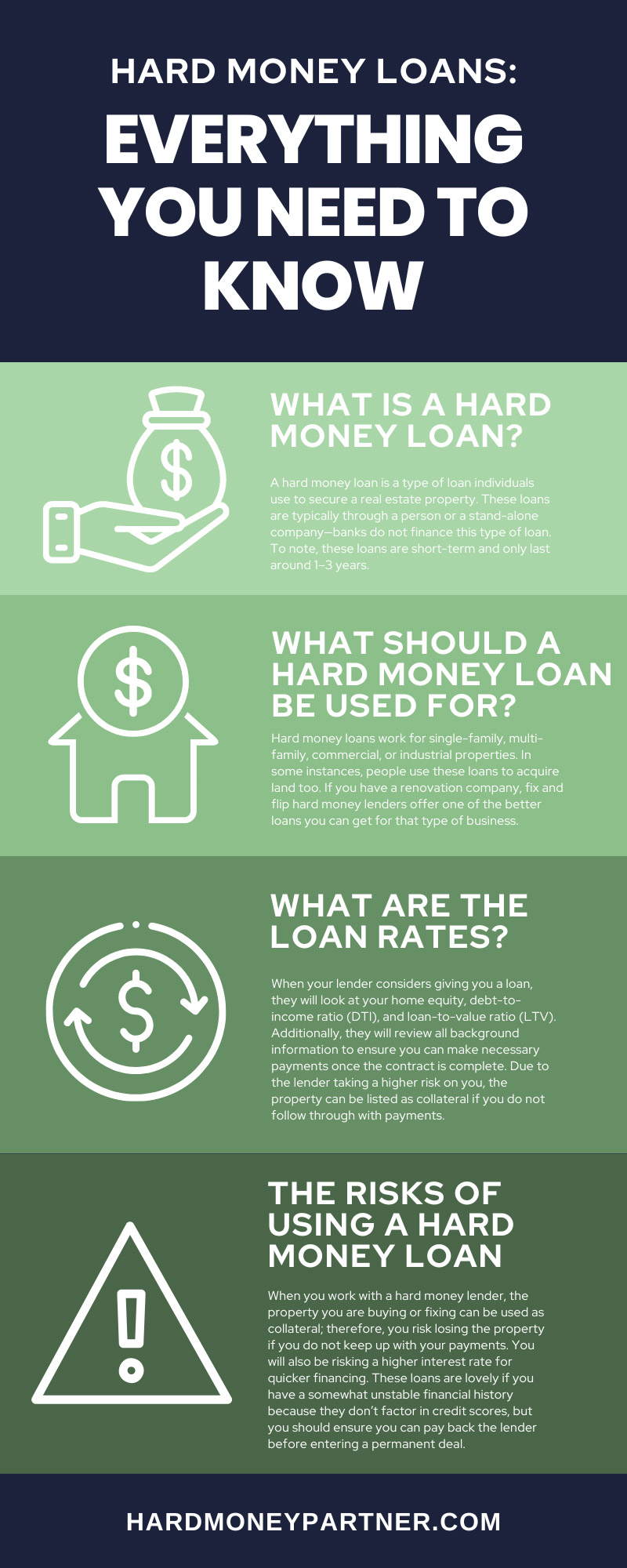

Comprehending Tough Money Loans

Among the defining attributes of hard money loans is their dependence on the value of the residential or commercial property as opposed to the debtor's creditworthiness. This permits consumers with less-than-perfect credit scores or those looking for expedited funding to accessibility funding more easily. Additionally, tough money finances generally come with greater rate of interest rates and much shorter repayment terms contrasted to standard financings, showing the raised danger taken by lending institutions.

These car loans offer various functions, including funding fix-and-flip projects, refinancing troubled homes, or giving capital for time-sensitive chances. Understanding the nuances of difficult cash financings is crucial for financiers that intend to utilize these financial instruments successfully in their actual estate endeavors (ga hard money lenders).

Trick Factors to Consider

Next, take into consideration the regards to the car loan. Various lending institutions offer varying rates of interest, fees, and payment routines. It is crucial to understand these terms completely to prevent any kind of undesirable shocks later on. Additionally, analyze the loan provider's financing rate; a speedy authorization procedure can be essential in competitive markets.

Another critical factor is the lender's experience in your specific market. A lender knowledgeable about neighborhood problems can supply useful insights and could be much more flexible in their underwriting process.

Just How to Review Lenders

Assessing tough money lenders entails a systematic strategy to guarantee you choose a companion that aligns with your financial investment goals. A trustworthy loan provider should have a background of effective deals and a solid network of pleased borrowers.

Following, analyze the loan provider's experience and field of expertise. Different loan providers might concentrate on various kinds of homes, such as residential, industrial, or fix-and-flip projects. Choose a lending institution whose proficiency matches your investment method, as this expertise can significantly affect the approval process and terms.

One more essential factor is the lender's responsiveness and communication style. A trustworthy lending institution should be prepared and easily accessible to address your inquiries adequately. Clear interaction throughout the analysis procedure can show just how they will certainly handle your financing throughout its period.

Lastly, guarantee that the lender is transparent about their procedures and needs. This includes a clear understanding of the documentation needed, timelines, and any kind of problems that might use. When picking a difficult money lender., taking the time to review these facets will empower you to make an educated choice.

Comparing Rate Of Interest and Fees

A detailed contrast of rate of interest and charges among tough cash lending institutions is necessary for maximizing your investment returns. Tough cash finances typically come with greater rates of interest compared to typical financing, typically varying from 7% to 15%. Understanding these rates will certainly help you analyze the prospective prices related to your financial investment.

Along with rates of interest, it is critical to assess the linked fees, which can dramatically affect the total funding expense. These charges may consist of source fees, underwriting costs, and closing expenses, usually revealed as a percent of the finance quantity. For circumstances, origination charges can vary from 1% to 3%, and some lending institutions may charge added fees for handling or administrative jobs.

When comparing lenders, consider the overall cost of borrowing, which incorporates both the rate More hints of interest rates and charges. This all natural technique will enable you to identify one of the most economical options. Be sure to inquire concerning any feasible prepayment fines, as these can impact your capability to pay off the car loan early without incurring additional charges. Inevitably, a cautious evaluation of rates of interest and fees will result in more informed loaning choices.

Tips for Successful Loaning

Understanding rate of interest and costs is only component of the equation for securing a difficult money financing. ga hard money lenders. To make certain effective loaning, it is essential to completely assess your monetary scenario and task the prospective return on investment. Begin by clearly defining your loaning purpose; loan providers are more probable to react positively when they recognize the intended use the funds.

Following, prepare a detailed company strategy that details your project, anticipated timelines, and economic estimates. This demonstrates to lenders that you have a well-balanced strategy, enhancing your trustworthiness. Furthermore, preserving a strong connection with your lender can be useful; open interaction promotes depend on and can bring about a lot more favorable terms.

It is likewise necessary to make sure that your building meets the lending institution's requirements. Conduct a thorough assessment and give all needed documentation to enhance the authorization procedure. Be mindful of leave approaches to settle the funding, as a clear payment plan guarantees lending institutions of your commitment.

Verdict

In recap, situating the finest tough cash loan providers requires a detailed exam of various components, including loan provider online reputation, lending terms, and expertise in home types. Effective analysis of lenders through contrasts of passion prices and charges, integrated with a clear service plan and strong interaction, boosts the probability of positive loaning experiences. Eventually, thorough research and calculated engagement with lenders can bring about effective monetary results in realty ventures.

Additionally, hard cash fundings usually come with greater passion prices and shorter settlement terms contrasted to traditional finances, showing the raised threat taken by lending institutions.

Report this page